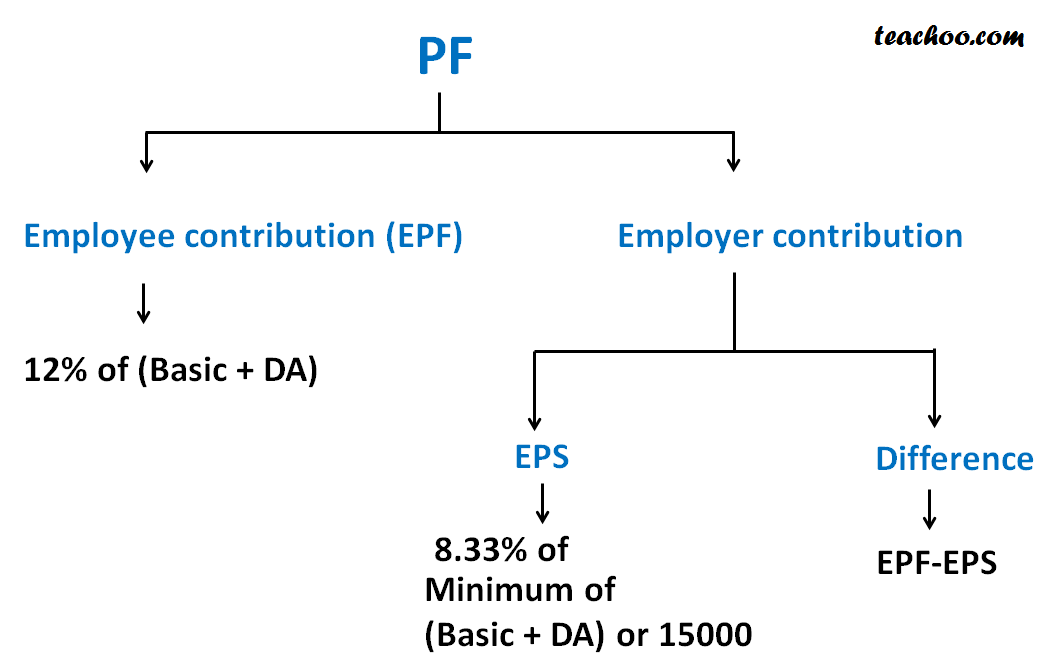

Register now by logging on to EPFO Employer Portal There is no last date for updating e-nomination. As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance.

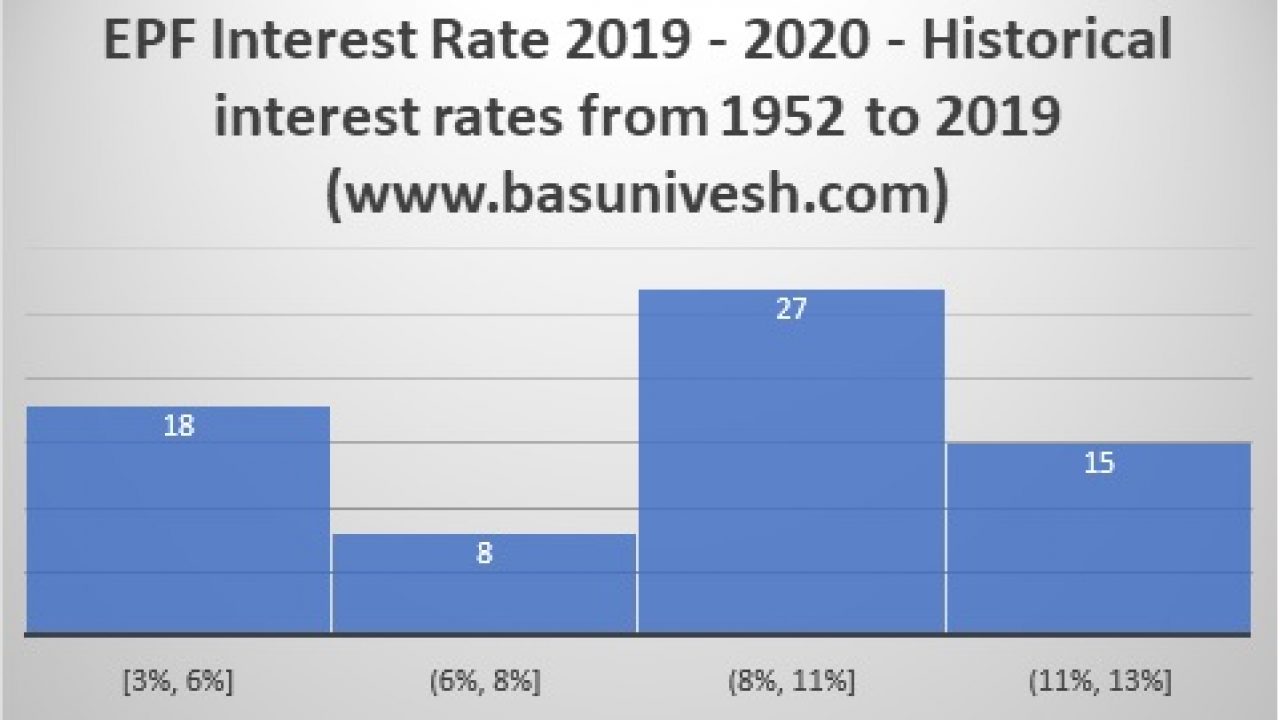

Epf Interest Rate 2019 2020 Historical Interest Rates From 1952 To 2019 Basunivesh

A series of legislative interventions were made in this direction including the Employees Provident Funds Miscellaneous Provisions Act 1952.

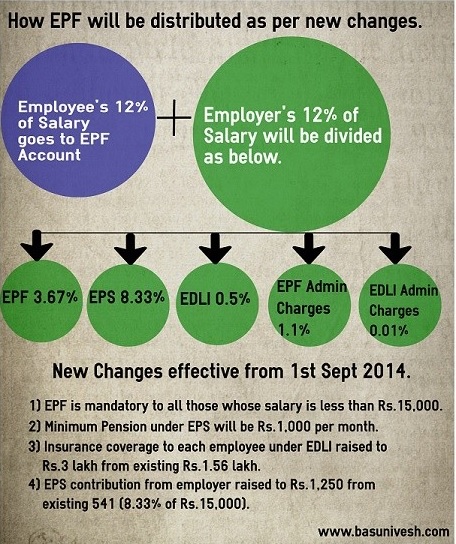

. The rate of interest for. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. At 85 this is the largest gap we are seeing when compared to the public provident fund PPF which is at just 71.

This privilege is only for the first three years of employment. Employers contribution towards Employees Deposit-linked Insurance Scheme is 050 and the administrative charges are 050. About Employees Provident Fund Organisation.

The last declared EPF interest rate was for the year 2019-20 which stood at 850. If you are interested to know the calculation of the EPF contribution formula you have came to the right place. In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia.

Employees EPF contribution rate. In early 2019 I registered myself for EPF i-Saraan previously known as 1Malaysia Retirement Savings Scheme or SP1M. And the best part is that the money that you.

Payment of 85 interest to around 6 crore EPF subscribers with the onset of the year 2021. Employers EPF contribution rate. Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952.

Can I make a personal contribution to my PF account. EPF Dividend Rate. Hike in EPF Interest Rates 2018-19.

Can an employee opt out from the Schemes under EPF Act. Theyll detect when receiving the EPF statutory contribution from the employer under statutory contribution and thus no longer on i-Saraan. Lets use this latest EPF rate for our example.

As per the Employee Provident Fund rules the employer contributions are payable on maximum wage ceiling of 15000. Click on the lower right button and back to the classic. In Many Companies Employee and Employer are Paying PF on higher amount of 20000 Employee Contribution EPF12 200002400 Employer Contribution EPS833150001250 Difference2400-12501150 Total Employer PF125011502400 Note- Even if PF is calculated at higher amount For EPS we will take 15000 limit only.

Out of the employers contribution 833 per cent goes into the Employees Pension Scheme. Pai CFP and Head - Products PPFAS Mutual Fund replies. The dividend rate of the EPF is always higher than Fixed Deposit Rate provided by bank.

Foreign workers are protected under SOCSO as well since January 2019. According to EPFO rules ex-employees cannot contribute to their EPF account since any contribution by the member must be matched with the employers share of contribution. EPF is a retirement benefits scheme under the Employees Provident Fund and Miscellaneous Act 1952 where an employee has to pay a certain contribution towards the scheme and an equal.

Presently the following three schemes are in operation. Employees contribution is 12 of Rs. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule.

Last Date for registration under ABRY is 31032022. You can also check the past changes in historical EPF interest rates. As mentioned earlier interest on EPF is calculated monthly.

But this rate is revised every year. Since 2020 the default. Above 15000 by submitting a joint request from Employee and employer as required in Para 266 of EPF Scheme.

Independent India 75. There are many advantages of EPF Self Contribution. The reduction in statutory rate of EPF contributions from 12 to 10.

For all your contributions the government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional. The interest earned on the EPF Account balance every year is tax-free. Monthly Contribution Employer and Employee.

As of now the EPF interest rate is 850 FY 2019-20. EPF Interest Rate - Interest rate of EPF is reviewed every year after consultation with the Ministry of Finance by EPFOs Central Board of Trustees. Besides we can get tax relief up to RM 6000 under Life insurance and EPF types.

Simpanan Konvensional Per Annum 2020. Employers contribution will also be Rs. Access to internet banking makes EPF contribution payments much easier now.

Per Annum Simpanan Shariah Per Annum. The EPF interest rate for FY 2018-2019 is 865. Employee Pension Scheme EPS.

Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550. Revised EPF Interest Rate for 2019-20. 6000 and it will go to the EPF.

EPF is an retirement investment plan opted by a number of employees as this has number of benefits. Malaysian age 60 and above. In the union budget 2018-2019 new women employees can make an EPF contribution of 8 instead of 12.

Monetary payments that are subject to SOCSO contribution are. Employees usually contribute 12 of their basic salary while the employer makes a contribution of 1361 towards the EPF. Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000.

Percentage of contribution Employees Provident Fund. However the contribution can also be done on higher wages ie. Hence you are not permitted to contribute.

EPF Contribution Rate 2022. For newly implemented areas the contribution rate is 1 and 3 respectively for employee and employer for the first 24 months. Step By Step Pay EPF Online.

With the EPF contribution rate of between 7 to 11 employee and 12 or 13. Those employees whose daily average wage is Rs 137 as these employees are exempted from own contribution The employer is required to pay his contribution 8 Rate of Employers Contribution. Your employers contribution to your EPF is also tax-free.

Epf Change Of Contribution Table Ideal Count Solution Facebook

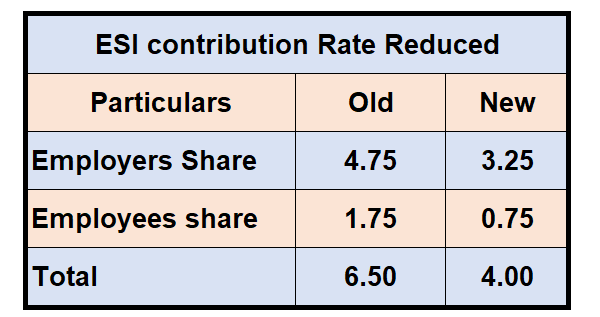

Government Reduces Rate Of Esi Contribution To 4 Hrapp

Epf A C Interest Calculation Components Example

Epf Interest Rate 2019 2020 Historical Interest Rates From 1952 To 2019 Basunivesh

20 Kwsp 7 Contribution Rate Png Kwspblogs

Singapore Cpf Vs Malaysia Epf Just An Ordinary Girl

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

What Is The Epf Contribution Rate Table Wisdom Jobs India

Epf Contribution Of Employee And Employer Rate Break Up

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Pf Contribution Rate From Salary Explained

Rates Of Pf Employer And Employee Contribution Pf Provident Fund

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Rates Of Pf Employer And Employee Contribution Pf Provident Fund

Rates Of Pf Employer And Employee Contribution Pf Provident Fund

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Epf Contribution Rate 2018 Isaiahctzx

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax